Shariah-Compliant Mutual Funds in India: A Guide for American Investors

You know what fascinates me about global investing? It’s how different cultures bring their unique perspectives to the financial world. Today, I’m excited to share something that perfectly exemplifies this: Shariah-compliant mutual funds in India. As someone who’s spent years analyzing various investment vehicles, I find these funds particularly interesting because they blend ethical principles with modern investment strategies.

Understanding Shariah-Compliant Mutual Funds

Picture this: You’re at a restaurant looking at the menu, but instead of choosing based just on taste, you’re selecting dishes that align with specific dietary requirements. That’s somewhat similar to how Shariah-compliant mutual funds work – they’re investment vehicles that follow Islamic law while seeking financial returns.

What Makes a Mutual Fund Shariah-Compliant?

Let me break down the key principles that make these funds unique:

- Interest-Free Investments: These funds completely avoid investments that generate interest (known as ‘riba’ in Islamic terms). You won’t find any conventional banking or insurance company stocks in these portfolios.

- Ethical Business Screening: The funds steer clear of companies involved in:

- Alcohol production or distribution

- Gambling

- Non-halal food products

- Entertainment businesses considered unethical under Islamic law

- Conventional financial services

- Financial Ratios: Companies in the portfolio must meet specific financial criteria:

- Debt levels must stay below certain thresholds

- Interest-based income should be minimal

- Cash and receivables should be within prescribed limits

The Indian Shariah Mutual Fund Landscape

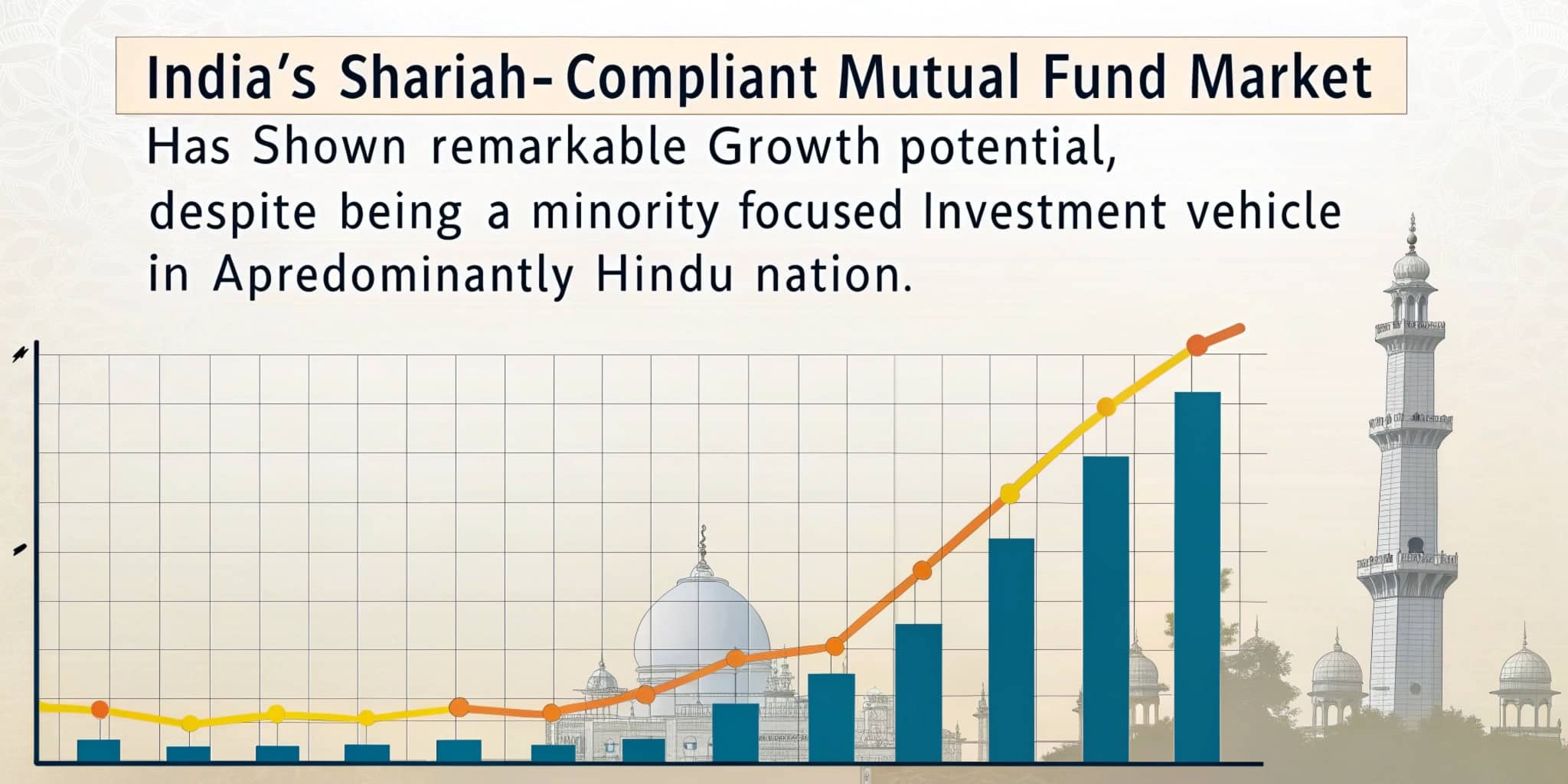

India’s Shariah-compliant mutual fund market might surprise you. Despite being a minority-focused investment vehicle in a predominantly Hindu nation, these funds have carved out a significant niche. According to recent data from LSEG (London Stock Exchange Group), the market has shown remarkable growth potential.

Popular Shariah-Compliant Funds in India

Let’s look at some key players:

|

Fund Name |

Benchmark |

Minimum Investment (USD) |

Key Features |

|

SBI Shariah Equity Fund |

Nifty 500 Shariah |

~$15 |

Large-cap focused, Growth oriented |

|

Tata Ethical Fund |

Nifty 50 Shariah |

~$12 |

Diversified equity, Value investing |

|

Taurus Ethical Fund |

S&P BSE 500 Shariah |

~$20 |

Multi-cap approach |

Why Consider Indian Shariah Funds?

As an American investor, you might be wondering why you should look at Indian Shariah funds. Here’s my take:

Geographical Diversification

India’s economy is growing at a pace that’s hard to ignore. When you invest in Indian Shariah-compliant funds, you’re not just getting ethical investments – you’re gaining exposure to one of the world’s fastest-growing major economies.

Ethical Investment Alignment

Even if you’re not following Islamic principles, these funds often align with ESG (Environmental, Social, and Governance) investing principles, which are increasingly popular among US investors.

Performance Metrics

Research published in the International Journal of Islamic Finance shows that Shariah-compliant funds often demonstrate comparable or sometimes better risk-adjusted returns compared to conventional funds, particularly during market downturns.

How to Invest as a US Citizen

Here’s what you need to know about investing in these funds from the US:

- Regulatory Considerations: You’ll need to comply with both US and Indian investment regulations. This typically means:

- Filing additional tax forms

- Working with a registered international broker

- Understanding FATCA requirements

- Investment Process:

- Open an international trading account

- Complete KYC (Know Your Customer) requirements

- Consider currency exchange implications

Risk Factors to Consider

Let’s be honest about the challenges:

- Currency Risk: The Indian Rupee’s fluctuations against the USD can impact returns

- Market Risk: Like all investments, these funds are subject to market volatility

- Liquidity Considerations: Some funds might have longer redemption periods

- Limited Universe: The investment universe is smaller due to Shariah compliance requirements

Looking Ahead: The Future of Shariah Funds in India

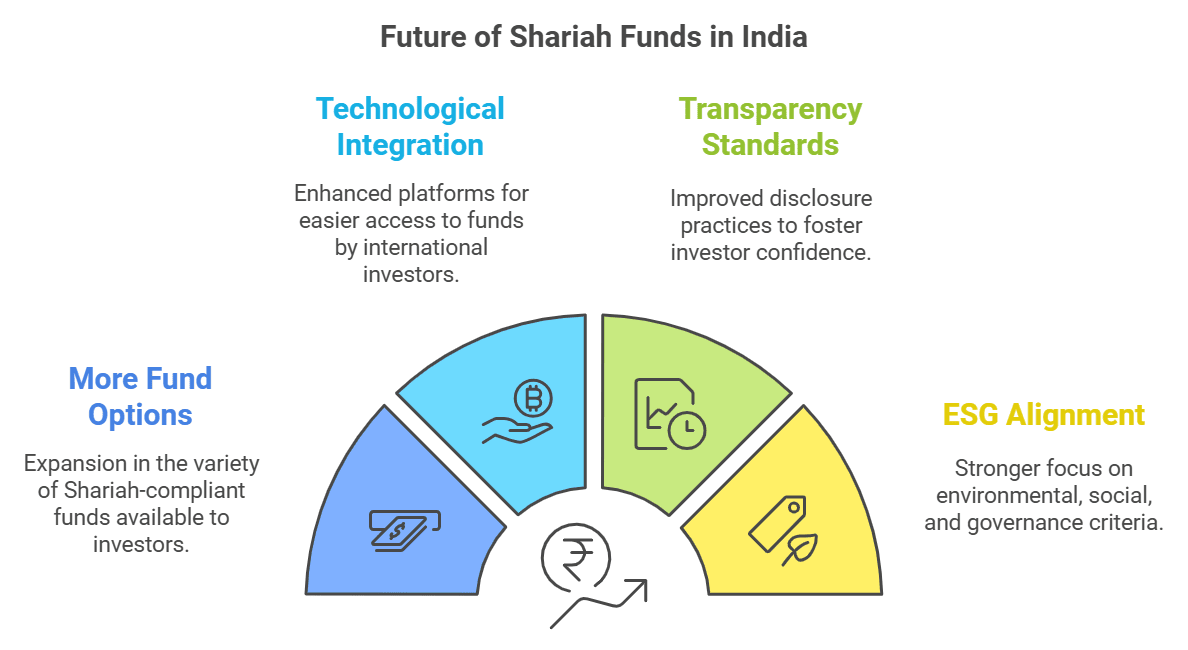

The future looks promising for these funds. With India’s growing financial market sophistication and increasing global interest in ethical investing, we’re likely to see:

- More fund options becoming available

- Better technological integration for international investors

- Enhanced transparency and reporting standards

- Greater alignment with global ESG standards

Final Thoughts

I believe Indian Shariah-compliant mutual funds represent an interesting opportunity for US investors looking to diversify their portfolios while maintaining ethical investment principles. Whether you’re following Islamic financial principles or simply seeking ethically screened investments with exposure to India’s growth story, these funds deserve consideration

Responses